Verizon Stock

In the telecommunications industry, Verizon might have caught your eye if you’re looking for a stable stock that pays dividends. The telecoms company Verizon telecoms Inc. (NYSE: VZ) is one of the biggest and best known in the world. Wireless, broadband, and fiber-optic connectivity are just a few of the services it provides. This piece will tell you everything you need to know about Verizon stock, from how it has done in the past to how the market is moving now and what the company’s growth prospects are for the future.

A Quick Look Back at Verizon Communications

Verizon was started in 1983 as Bell Atlantic. After joining with GTE in 2000, it became a huge phone company. The business has grown very quickly since then, especially in the digital market. Verizon has put a lot of money into infrastructure over the years, especially to grow its 5G network. This has made it a star in next-generation technology.

Figure out how Verizon makes money in the phone business.

At its core, Verizon is a phone company that offers services like broadband, fiber optics, and talk and data services over the air. It makes most of its money from its cellphone business alone. The number of postpaid wireless subscribers at Verizon has been a big source of income and a big factor in how the stock has done.

Businesses in media and technology

Verizon’s main business is still telephones, but the company has also branched out into media and technology. Verizon bought companies like Yahoo and AOL to become a digital media giant, but these investments haven’t always paid off.

Verizon’s Position in the Telecommunications Market

There is competition from AT&T and T-Mobile.

Verizon works in a market with a lot of other companies. AT&T and T-Mobile, Verizon’s major competitors in wireless services, are always trying to catch up. Verizon has the best customer happiness and most reliable network, but the competition often makes prices go up and new services come out.

Presence around the world

Verizon is mostly an American company, but it has made some moves into foreign markets. But it’s not as well known around the world as some of its competitors, which makes it harder to expand into new areas.

Things that affect how well Verizon stock does Technological progress

Technology is very important to the telecom business. Verizon has been putting a lot of money into its 5G network, which will allow faster data speeds and open up new business possibilities. The successful launch of 5G is expected to have a big impact on how stocks do in the future.

Environment of Regulation

Telecommunications companies like Verizon have to follow strict rules, which can make it harder for them to make money. Keep an eye on changes to the rules, especially those that affect net neutrality and data privacy.

Verizon’s Financial Health: Sources of Income

Verizon makes money in a number of ways, such as through wireless services, internet, and business solutions. A big chunk of the company’s total revenue comes from its wireless business, which keeps the cash flow stable.

Margin of Profit and Costs

Verizon’s profit margins stay the same, but it has to pay a lot for capital goods, just like other telecom companies. Especially with the ongoing 5G expansion, building and keeping a cutting-edge network costs a lot of money.

History of Dividends and Investor Appeal

Investors are drawn to Verizon stock in part because it consistently pays out dividends. Verizon has a past of paying dividends, which makes it a good choice for investors who want to make money. The company’s dividend yield is generally higher than the average for its industry, which makes it even more appealing.

Risks Linked to Verizon Stock Economic Downturns

Verizon isn’t immune to changes in the economy as a whole, like most stocks. When the economy is bad, people may not spend as much on premium services, which could affect the company’s earnings and stock success.

Disruptions in technology

It’s true that 5G is both a chance and a risk. The stock may go down if Verizon fails to implement 5G well or if rivals get ahead of them. The telecom industry could also be changed by new technologies like internet that is built on satellites.

Verizon’s Part in Investing in 5G Infrastructure for Growth

Verizon has put a lot of money into 5G infrastructure, which puts it ahead of the competition for next-generation telecom services. People think that these efforts are important for the company’s growth in the future.

What It Means for Verizon Stock

The growth of Verizon’s stock will depend a lot on how well 5G works. Should 5G services be easily rolled out and widely used, both sales and stock prices could go up.

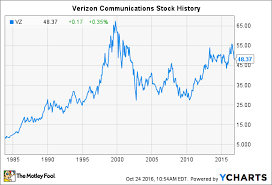

Recent Changes in Verizon’s Stock Price

In the past few years, Verizon stock has gone up and down due to both general market trends and things unique to the company. The stock hasn’t grown quickly, but it has stayed stable and paid out steady payments, which is a big draw for long-term investors.

Looking at the trends in Verizon’s stock price

Earnings reports, customer growth, and new technologies can all have an effect on Verizon’s stock price. Investors should keep an eye on these trends to see how the stock might move in the near and far future.

Choose between long-term and short-term investments. Which is better for Verizon?

Verizon is seen as a good long-term investment by most investors because it pays stable income and runs a solid business. Short-term traders may not have as many chances, though, since the stock’s price doesn’t generally change quickly.

Verizon Home Internet

Verizon Internet

Verizon Outage

Ultra Mobile SIM

Tips on How to Buy Verizon Stock

Buying Verizon stock is a simple process. A brokerage account lets you buy it. You can do this online or with the help of a financial expert. Before you buy something, make sure you know about the stock and market conditions.

What Experts Think About Verizon Stock

A lot of financial experts think that Verizon is a great stock to buy for portfolios that focus on dividends. It is a good choice because it has a steady cash flow, leads the market, and could grow with 5G. But because of competition and high capital costs, some experts say to be careful.

Verizon Communications is a big name in the telecommunications business. It gives investors both security and room to grow. The stock may not go up quickly, but its steady dividends and strong place in the market make it a great choice for people who want long-term growth and income. Verizon’s future depends on how well it rolls out 5G, but the company is currently in a good situation to handle the challenges that lie ahead.

FAQs

Is Verizon stock a good buy for the long term?

Long-term investors are often told to buy Verizon because its dividends are stable and its business plan is reliable.

What are the main risks of putting money into Verizon?

Some of the biggest risks are bad economic times, problems with technology, and high costs for building up 5G networks.

How does Verizon stack up against its rivals?

Verizon has the best customer service and the most reliable network, but AT&T and T-Mobile are very close behind in terms of price and new ideas.

Does Verizon give out money?

Yes, Verizon has a past of giving regular dividends, which makes it a good choice for investors who want to make money.

What part does 5G play in the future of Verizon?

Verizon’s future growth will depend on how well its 5G network works, which will have an effect on both its income and stock price.

Leave a Comment